The Bull Market Powers Higher

As we expected, many companies (about 67%) are beating the bottom line consensus estimates for Q1. The earnings bar was set low by both the companies and analysts coming into earnings season making the forecasts easier to beat. And the prior periods of weak guidance...

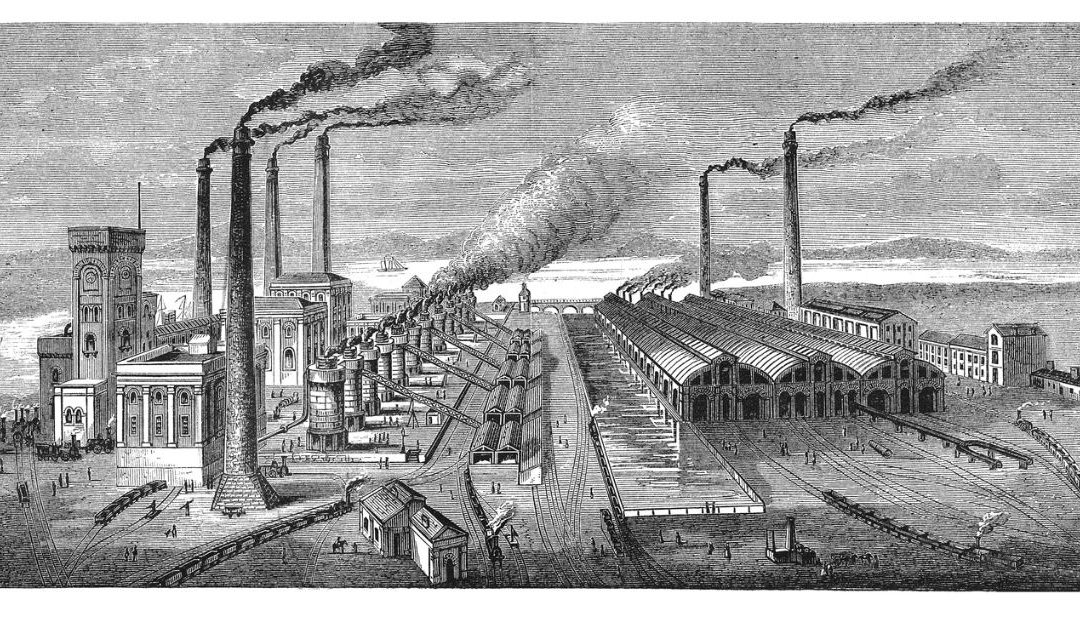

The Fourth Industrial Revolution

What a difference a quarter can make. Last week Fed Chairman Powell all but admitted that he and the Fed were wrong raising the Fed funds rate in December and all but called off interest rate increases in 2019. They expect one increase in 2020. The initial market...New Sector Leadership

The stock market continues its amazing run from the December 24th low and is now up about 18% since then. The percentage of stocks in the S&P 500 that are trading above their 50-day moving averages crossed above 90% for the first time in nearly three years. A...

Can 2019 Earnings Drive Stock Prices Higher?

My business partner and co-author of these commentaries, Steve Riley, has decided to leave Clearview to pursue other interests. His many contributions will be missed. This week marks the anniversary of the January, 2018 fevered peak in stocks. Since then stocks are...