Recent Commentary

Show Us the Money

Although we were disappointed stock prices didn’t react to spectacular firstquarter earnings (+25%), we remain very interested in what corporations are doing with the extra cash and how this might eventually boost share prices. Share repurchases. First...

Fear, Greed, and Valuations: An Update

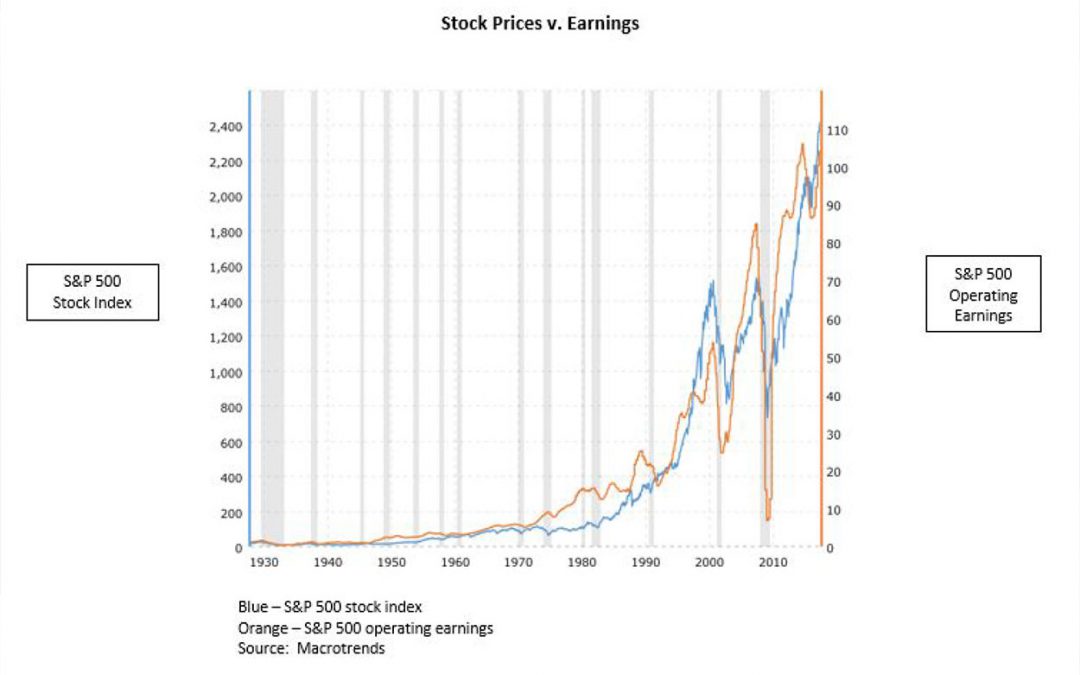

Earnings reports for Q1 have been nothing short of spectacular (helped by the recent reduction in corporate income tax rates). Reported earnings growth to date is 23.2% with revenue growth of 8.4% (source: FactSet). Net profit margins are 11.1%, a postfinancial...

Can FANG and Tech Recovery Heal the Stock Market?

Earnings season starts in earnest next week. Can the expected surge in earnings stabilize the market and provide a base for the next rally phase? The big question is whether the good earnings forecasts are already discounted in share prices. We won’t know...

The Three Types of Corrections Investors Face

The corporate earnings growth rate (year/year) for Q4, 2017 was a spectacular 15.2%, the highest quarterly growth rate reported in over six years. It marked the third time in the past four quarters earnings growth was in double digits. Revenues grew an impressive 7.9%...

The Sweet Smell of Large Caps

The unfolding 2018 market narrative trumpets the expectation of strong corporate profits ahead. But first, let’s take a look at how fourth quarter 2017 reports are shaping up so far. Fourth quarter earnings are expected to grow 11.2% (exfinancial companies). We are...

Market Jitters Send Stocks Down 10%

As of last night’s close, the S&P 500 has dropped 10% in the last nine trading days. Investors are nervous about the rapid escalation in interest rates this year as well as a whiff of inflation with wage gains up 2.9% in January. Many are concerned the Fed will...

Investor Balance Sheet for 2018

It is with warmth and sincere gratitude that we at Clearview wish you a fulfilling New Year. Every year is the same; Wall Street is forecasting a 10% return for stocks for 2018. Some firms are projecting even higher returns seemingly trying to out forecast their...

Don’t Fear the Fed

Last year was another solid year for investors, especially following a stellar 2013 of 30+% gains. For the year, the S&P 500 Index rose 11.4% while the Dow Jones Industrial Average increased by 7.5%. The average U.S. mutual stock fund rose 7.6% and the average...

The Bull Market Remains Intact

The S+P 500 recorded its seventh consecutive quarterly gain in the third quarter, up 0.6% while the Dow was up 1.3%; However most stocks did not fare as well as the popular averages. The average diversified U.S. stock fund was down 1.9%. Small caps were especially hit...

Stock Market Delivered Positive Returns

The first half of the year has now ended with the stock market having delivered positive returns. The S&P 500 stock index rose a solid 6.1% while the Dow Jones provided a modest 1.5%. And after GDP growth of -2.9% in the first quarter, Q2 GDP growth is forecast to...