Even though last week’s CPI (consumer price index) came in hotter than expected, we would argue against interpreting results as a notable uptick in inflation. “Supercore” (which strips out a range of very volatile categories) continued to trend weaker. We were happy to see both the stock and bond markets shrug off the small miss without any tumult. After the report, the markets raised the probability that the Fed will cut rates in March to over 80%.

The PPI (producer price index) was weaker than expected when announced last Friday. The PPI has completely unwound the very high inflation period of 2021 and 2022. A big part of that is commodities including food and energy, both deep in deflationary territory.

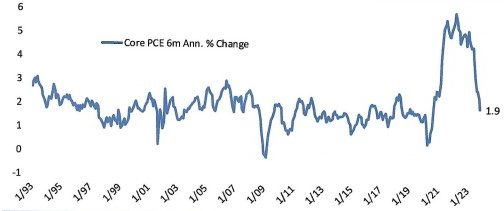

Finally, the Fed’s favorite inflation indicator, the PCE (personal consumption expenditures), showed inflation has returned to target. Core PCE prices were up only 1.9% annualized over the last six months. See the graph below:

PCE CORE INFLATION IS BACK TO TARGET…

Source: Bespoke Investment Group

Our take: Inflation is slowing and will continue its downward push. The Fed’s 2% year-over-year target should be reached around mid-year.

We remain an adversary to environmental, social and governance investing (ESG). In an earlier commentary we even thought the practice may be considered illegal for institutional accounts (pensions, endowments, profit sharing, etc.). Sure enough, some governors have outlawed the use of ESG investing in state-sponsored retirement portfolios.

ESG’s hallmark investment view rests in the support of stakeholder capitalism, not shareholder capitalism as is commonly practiced. Shareholder capitalism is traditional. That is, companies are run for the benefit of shareholders. Stakeholder capitalism is run for the benefit of clients, employees, society, and then shareholders. Many consider stakeholder capitalism to be woke capitalism. Many ESG investors will accept lower returns in exchange for being a socially responsible investor that include various parameters including carbon footprint, gun control, diversity and inclusion, among other factors. Proponents say investment returns are not compromised, but that has never been proven.

A constrained strategy (like ESG) cannot beat an unconstrained one. Any short-term alpha (excess return) is a result of outsized flows into those strategies, driven in part by aggressive marketing by Wall Street. New products often mean higher fees.

Our conclusion: Investing cannot be a vehicle for creating social change. In fact, the concept should be retired.

ARTIFICIAL INTELLIGENCE REMAINS THE NUMBER ONE

INVESTMENT THEME IN 2024

Market cycles need themes and “AI” has been this bull market’s theme in a big way. There is a good chance this becomes a secular rather than a cyclical wave, which is bullish for equities. Companies are now locked in on the AI race so they don’t get left behind. In fact, Google co-founder Sergey Brin has returned to Alphabet to take the lead on AI at the company.

AI should be an even bigger story in 2024. The AI theme should play out over years and decades, not just months. You could see AI’s promise at the 2024 edition of CES last week (Consumer Electronics Show). AI was essentially the only topic at the tech trade show. Everyone asks people coming back from CES about the coolest thing on display. The entire tech industry has single-mindedly placed all of its eggs in a single AI-generated basket. And investors who thought AI was just hype earlier have come around.

We embraced the theme early in 2023 and have aggressively added AI exposure to client portfolios since then. We own both creators of AI technology as well as companies that will benefit from the efficiencies of using that technology. We are very excited about AI. This may be as powerful as the introduction of PCs and the internet in the 1990s.