Last year was another solid year for investors, especially following a stellar 2013 of 30+% gains. For the year, the S&P 500 Index rose 11.4% while the Dow Jones Industrial Average increased by 7.5%. The average U.S. mutual stock fund rose 7.6% and the average stock-picking hedge fund appreciated 2%.

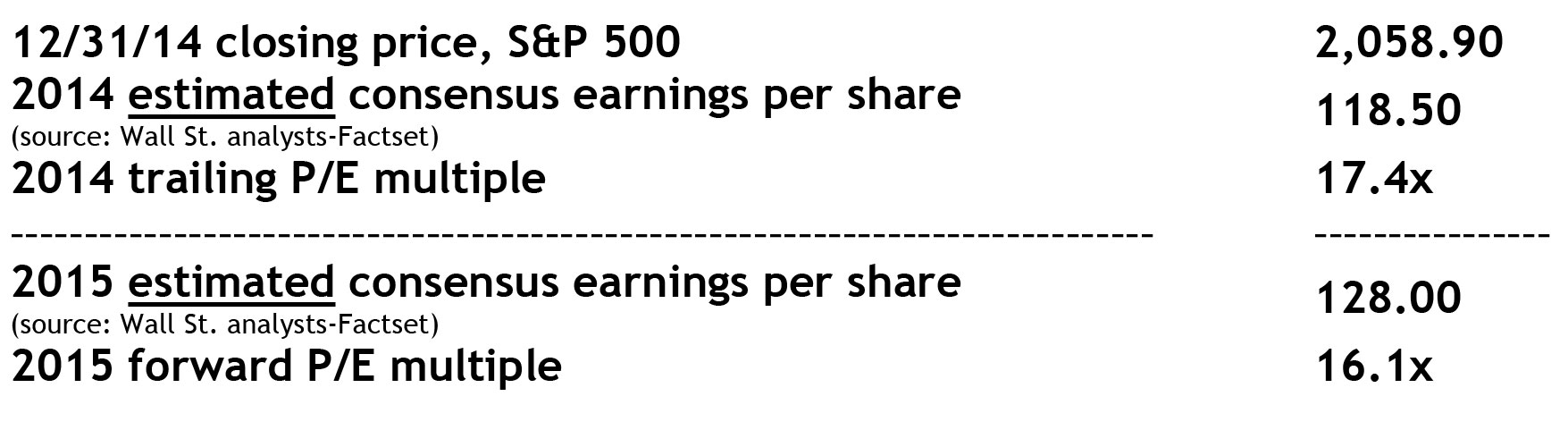

We will not pretend to know where stocks will be precisely one year from now. However, the exercise of careful forecasting can be helpful in creating a disciplined checklist of all the factors that can affect stock prices over the next 12 months. Our forecast is for stock prices to rise in tandem with earnings growth in 2015, currently estimated at 6-8% growth by many Wall Street analysts (source: Factset). Adding in a 2% dividend yield, we expect a total return this year of 8-10%. Our forecast assumes no change in Price/Earning (P/E) multiples which are always difficult to gauge. The current P/E multiple on

2015 estimated earnings is 16.1x, which is about average going back to the 1920s.

Here are earnings estimates for 2014 (2014 earnings are not yet final) and 2015 with corresponding trailing and forward P/E ratios:

We believe we are in the seventh inning of the bull market. Some of the best gains, however, often come in the latter stages of the cycle like the 1990s (1997- 1999). Here are more reasons why we remain bullish:

• Three factors that seem probable for next year include: the U.S. economy will continue to hum along; more jobs will be created as unemployment decreases; and the Fed will raise rates only modestly late in 2015.

• More companies have become shareholder friendly. That is, they buy back stock, increase dividends, and consider spinoffs to create value. Also, mergers and acquisitions push stock prices higher.

• Foreign investors are flocking to U.S. stocks and consider our economy and equity markets the best game around.

• Most bull markets die in anticipation of the next recession which is not currently in sight.

• The average gain in the third year of the presidential cycle is 18.5%. Legislative gridlock is great.

What about the Fed and its plan to raise rates later this year? The S&P 500 has risen 12 out of the last 14 tightening cycles going back to 1958. Sure, returns are higher when the Fed is accommodating, but this statistic should dispel the notion of going against the Fed. The biggest risk of fighting the Fed typically comes late in the cycle when the economy is overheating or stock market valuations are too high. Neither condition is present currently so don’t fear the Fed.

What else can we expect? More volatility. Even though market timing doesn’t work (see our report, Market Timing: Missing the Best Days) investors still try, especially late in the cycle. Now it’s called “risk on–risk off.” Higher volatility is normal for the latter stages of a bull market as investors get increasingly nervous. Also, geopolitical risks are high right now, and while they do not spur bear markets by themselves, they certainly will add to volatility if values get stretched.

What will lead the equity markets? Large caps almost always outperform small caps late in the cycle because of their sustainability of earnings growth. This trend should help us as we typically concentrate portfolios in large cap stocks. Ninety-two percent of our stocks in our Core strategy are large caps, 100% in Dividend Growth and 80% in Focus 20. Second, our economy is (modestly) accelerating so cyclical sectors should do well again in 2015. We continue to be over-weighted in financial, consumer discretionary and industrial stocks. To summarize, we expect high single digit total returns in stocks for 2015 with increased volatility like we saw last December. Stock valuations, especially with large cap stocks, are reasonable which gives us confidence the bull market will continue

Bond Market Results: A Mixed Bag

As the fourth quarter of 2014 began, investor confidence in the economy had improved. The economic recovery was accelerating, corporate earnings were healthy and inflation remained a non-issue. Quantitative easing (QE) had reached the unwind phase, which meant rates were likely to rise somewhat over time, but even this was not perceived as a problem for bullish bond investors. In fact, investors of high quality bonds had been handsomely rewarded through steady price appreciation (lower rates) throughout the year.

However, with the onset of the holidays, the price decline in commodities (particularly energy related) had become worrisome. Beginning in December, the severity of the oil price decline fed back into the currency markets causing a spike in volatility across the equity and debt markets. Currency weakness has now taken hold across emerging market countries (especially commodity exporters like Russia where central bankers felt compelled to raise Repo rates by 6.5% on December 16 to a remarkable 18%). There is growing risk that the Russian crisis could spread to other emerging markets in early 2015–especially those countries without sufficient foreign currency reserves to weather the storm. What this means for high grade bonds is less clear, though 10-year U.S. Treasury bonds had rallied from 3% yield to around 2.15% by year’s end (when bond rates fall, prices rise). This rally reflects price appreciation of over 12% according to Ryan ALM Indexes.

“Bond imposters,” securities offering greater levels of yield or income at the cost of credit quality, or guaranteed final maturities (such as high-yield, emerging market sovereign and leveraged loan portfolios) have come under growing pressure as a result of the volatility. Their equity-like and illiquid characteristics have caused violent price swings as investors have grown uncomfortable, seemingly overnight, with these holdings. Growing geopolitical tensions and a “risk-off” mentality among investors in this space has clearly impacted buyer interest in holding higher risk bonds. We believe that our clients should avoid these lesser quality bond imposters as their tactical nature means they will need to be sold prior to maturity which may not be easily accomplished when liquidity dries up as it has recently.

To recap, high quality bonds had a great 2014 but U.S. Treasury yields have been falling (prices rising) for over 30 years. Non-investment grade “bond imposters” had a challenging finish to 2014 but remain richly priced and at risk for further decline. With 90-day T-bill rates earning next to nothing (at 0.02 basis points), can 2015 be another banner year for bonds? Fixed-income no longer provides the benefit of income. This trend is bound to reverse course at some point–but when is not clear? Savers and retirees unfortunately remain among the most mistreated by central bankers’ policy and this could take years to resolve. We continue to purchase high quality, short and intermediate maturity bonds for our clients. We firmly believe that these bonds are appropriate in diversified portfolios as they can help to protect investor principal when interest rates rise or stocks decline and can be held to maturity without fear of default.