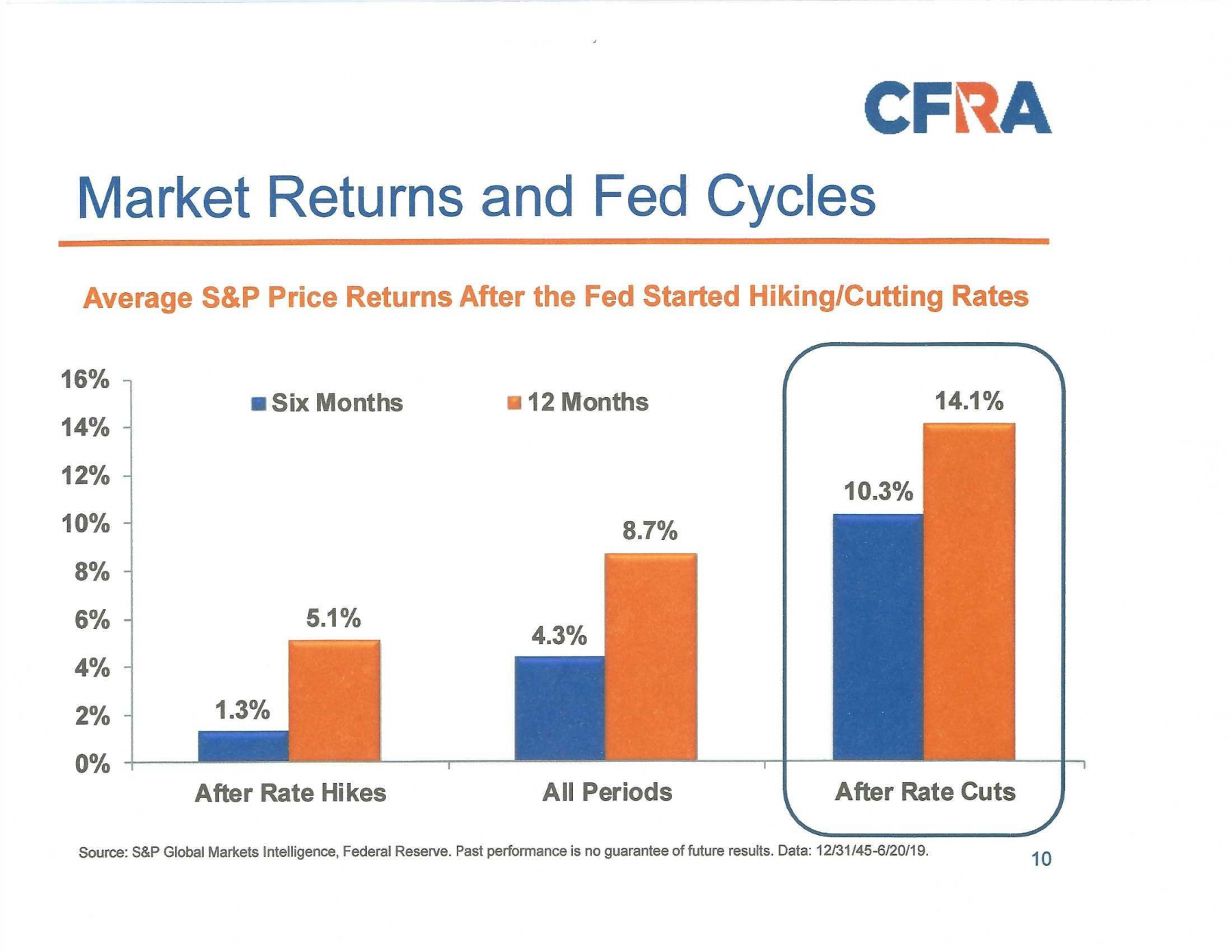

WHY INVESTORS SHOULD CARE ABOUT RATE CUTS Many investors are aware that stocks perform better when the Fed is in an easing cycle. Stocks can appreciate when rates go up, too, but the magnitude of the gains is much smaller. “Don’t fight the Fed” is the old adage. Now that the Fed is on our side, what can investors expect going forward?

According to this study, we could see double-digit gains over the next six and 12 months. But how much of yesterday’s cut has already been baked into share prices resulting in strong YTD gains in stocks? We certainly won’t know that until later. But this is why investors have been so excited about the prospects of a new easing cycle. Yesterday’s cut was widely anticipated with a 100% probability according to market polls.

During yesterday’s Fed press conference, stocks accelerated to the downside when Chairman Powell stated this rate cut is a mid-cycle policy adjustment and not necessarily the start of a lengthy cutting cycle. He later walked that back and said the Fed was not committed to a single cut or series of cuts. We think the modest policy adjustment is a positive. It satisfies the investors’ demand for lower rates without signaling a growing sense of urgency by Fed officials. The Fed will likely offer a second-round cut later this year to support the expansion. |