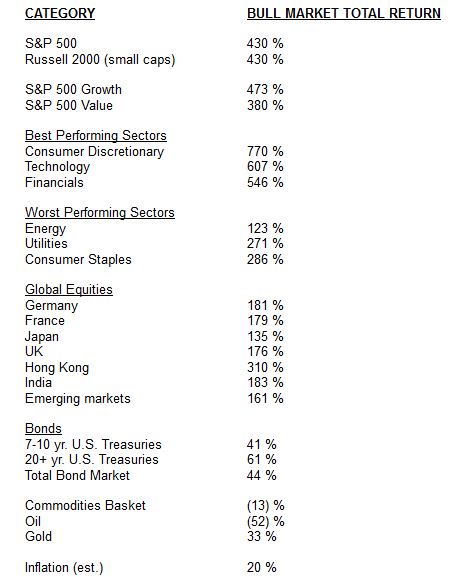

The Bull Market Powers Higher With recent all-time highs for the S&P 500, the bull market officially continues and is now the second longest bull market since WW II at 3,703 days. Many other markets are joining the rally. More than half of 29 major global indexes are within 5% of 52-week highs. Here are returns for different investment categories over the bull market’s 10+ years:

Source: Bespoke Investment Group

U.S. equity investors have enjoyed terrific returns year-to-date. It seems like the number one catalyst for the rally (a Fed that turned dovish) is still giving us the green light based on Fed Chairman Powell’s press conference yesterday. But there are always things to watch and valuation is one of them. Stock market valuations have now grown to be in line with the last year’s September peak and just slightly below January 2018’s peak. We know what happened the last two times we hit this valuation level so it is prudent to be cautious in the short term and trim overweighted positions, and also check that portfolio equity ratios are not extended outside the target range. |