|

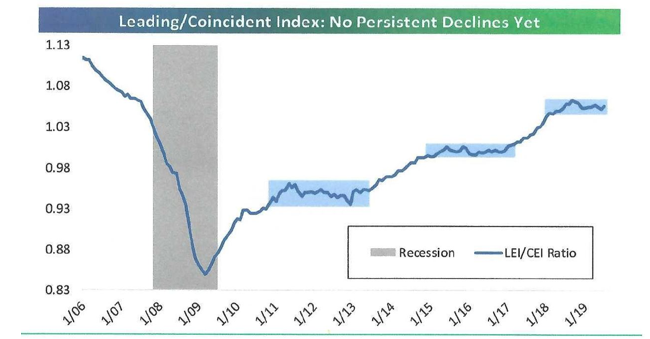

Source: Bespoke Investment Group – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

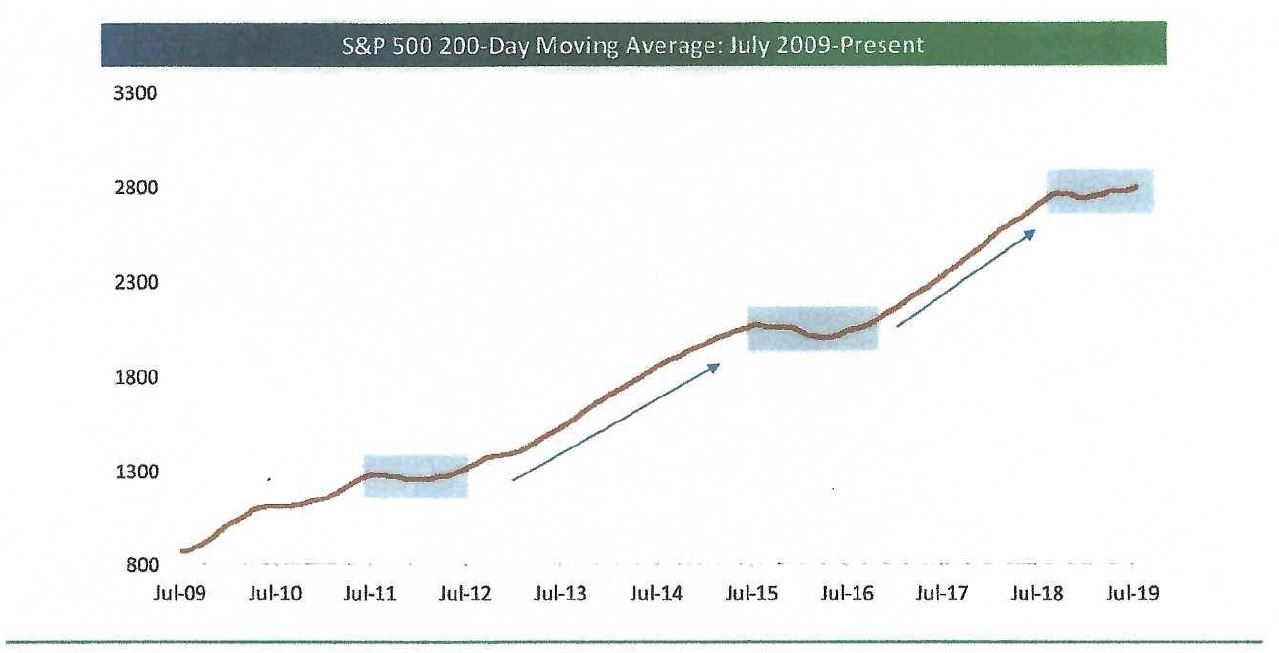

Source: Bespoke Investment Group – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

The Bond Market Takes Center Stage Why Interest Rates Plunged Last Month 100 Year U.S. Treasury Bonds? The bond market had a strong year last month! Long-term Treasuries (20+ year maturities) advanced about 10% while intermediate-term notes rose about 4%. The 10-year Treasury yield is now less than 1.5% with the 30-year under 2%. What is causing this new found love for bonds? It comes down to three primary reasons:

|