With heartfelt appreciation for our relationships with clients and friends,

we wish you and your loved ones a very Merry Christmas and Happy Hanukkah.

- Last week saw two IPOs deliver dramatic pops. Food deliverer DoorDash gained 86% on day one and Airbnb surged 113% on its first day of trading. Only eight IPOs have doubled or better on their first day since 1995, including five this year alone. IPO behavior is starting to look very frothy and smacks of “irrational exuberance. ”We hope it doesn’t spill into the broader market. It hasn’t yet.

- The recent rotation out of some of the FANG+ names is attributable to profit-taking in our view, rather than concern that the rationale for tech stock investing is running out of steam longer term. The ubiquitous nature of technology is embedded across broad segments of the world economy, including business, the consumer, and government entities. Consumers’ relationship with technology appears likely to broaden further with the introduction of 5G, increased use of technology in the workplace and home, and an upgrade cycle tied to a world of technology innovation. Tech is becoming more accessible and affordable. We will continue to overweight technology stocks.

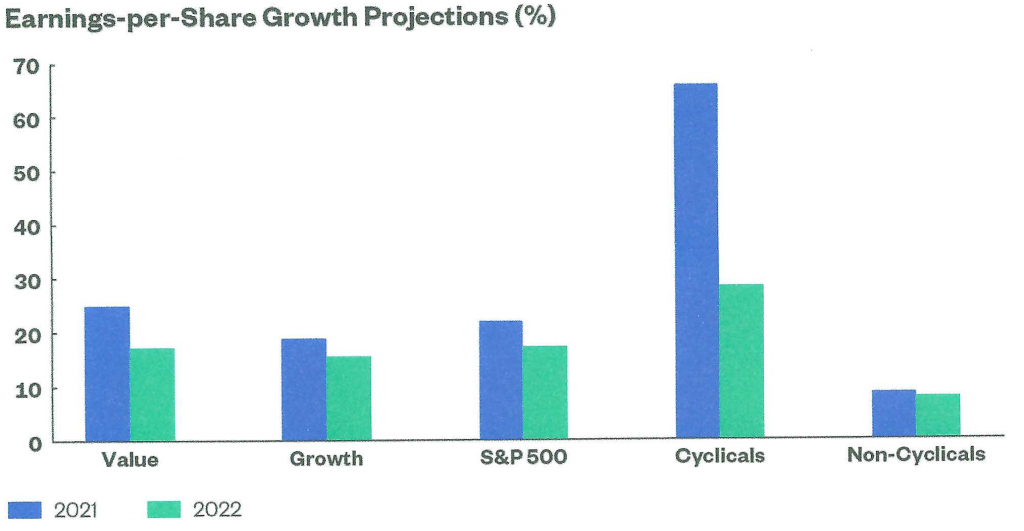

- As you would expect early in an economic recovery, profit growth expectations for cyclical stocks are eye-popping, estimated at 70% in 2021 and 30% in 2022. Cyclical stocks have caught fire since Pfizer’s (and others) early November announcement about their promising vaccine combined with expectations that the economic rebound will continue. The bar chart below shows profit growth expectations for select categories of the market:

Sources: FactSet, Standard and Poor’s, Thomson Financial, and CreditSuisse.

Also, value stock profit growth is expected to outshine growth stock projections. This is all textbook early cycle behavior and gives us confidence the new bull market is in its early stages. Of course, there will be many corrections along the way just as there were in the March 2009-February 2020 bull market.

THE 60/40 PORTFOLIO STRATEGY WINS AGAIN – AND MUZZLES CRITICS

A balanced portfolio of stocks and bonds was among the few respected rules in investing for decades. Yet doubts about the approach grew after the pandemic hit and turned 2020 into a year like no other. Critics of the 60% stocks/40% bonds portfolio were quick to pounce on the fact that interest rates are low and likely to stay low. As a result, the fixed income portion of the portfolios may provide little return. Instead, critics advise the 40% traditional fixed income portion should include REITs, MLPs, junk bonds, preferred stocks and the like – mostly higher risk choices in an effort to juice returns. This doesn’t make sense in our view. Balanced portfolios are meant to be just that – balanced. Traditional bonds provide an effective offset to stocks. Bonds are more stable and provide ballast for portfolios in rough waters – even if today’s yields are low. We think if an investor wants to take more risk in the 60/40 portfolio, we suggest increasing the equity ratio rather than adding these alternative equity-like investments. The potential rewards are greater.

How has a 60/40 portfolio done this year? It depends on the types of stocks and bonds held (including maturity length). Using index returns, a 60/40 portfolio holding longer bonds is up about 10-11% YTD, and 8-9% for a portfolio holding shorter-term, higher-quality bonds. Even the critics agree these are attractive returns. Traditional balanced portfolios still work.