We may be in a bull market, but outside of the mega-caps in the S&P 500, it has been a flat year for the stock market. The S&P 500 is up a rosy 11.7% through September, but the median S&P 500 stock is up just 0.4% YTD. And the broader market is up less than 2% YTD. We measure broader market performance by looking at these two indexes:

– Unweighted S&P 500 (all stocks are weighted equally, which dilutes the effect of the mega-caps)

SEPT YTD: 7%

– NYSE composite (1900 stocks of varying cap sizes, also diluting the mega-caps)

SEPT YTD: 1.4%

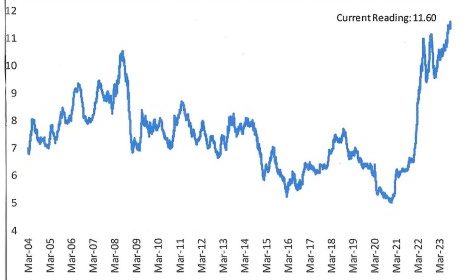

One of our favorite research firms, Bespoke Investment Group, has created a new misery index called “MORTGAS.” The index is the sum of the 30-year national fixed mortgage rate and the average national price for a gallon of gas. Mortgage rates are hitting new multi-decade highs, and gas prices are closing in on $4/gallon. Below is a graph for this newly created index going back 20 years:

Bespoke’s MORTGAS Index: Mortgage Rates + Gas Prices (Last 20 Years)

Source: Bespoke Investment Group

As you can see, the index is at a 20-year high. We are going to need to see some relief on both of these fronts, or else the consumer is eventually going to break.

Earlier in the economic cycle, the Fed viewed NOT hiking rates as the risky approach. Now, it is the opposite. That shift in the balance of risks means the Fed can feel comfortable with holding the Fed Funds rate unchanged for an extended period as those elevated rates work their way through the economy and slow economic activity.

The Fed is raising GDP forecasts, cutting unemployment forecasts, cutting core personal consumption expenditures (PCE) forecasts, and wants to leave rates on hold for longer rather than pushing the terminal rate higher. We agree with the seven FOMC (Federal Open Market Committee) members who forecast no more rate hikes as very good inflation reports are likely to continue.

WILL THE CONSUMER CONTINUE TO KEEP US OUT OF RECESSION?

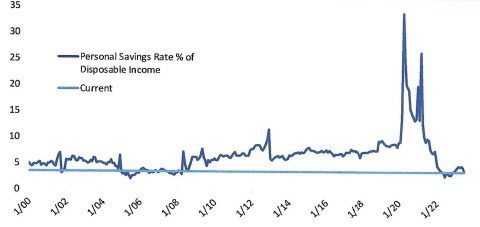

Since consumer spending accounts for about 70% of U.S. economic activity, economists pay close attention to consumer cash reserves, savings rates, debt service ratios and the mood of consumers (among other things) to anticipate how consumers are likely to spend in the future. Currently consumers have solid cash reserves relative to consumption (although there is less at lower income brackets). Even after adjusting for inflation, cash balances appear elevated relative to before the pandemic. This is especially important since the savings rate is historically low as shown below:

Savings Rates Are Low … But Could Fall Further

Source: Bespoke Investment Group

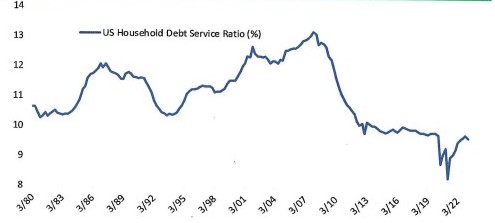

The debt service ratio, however, remains historically modest, suggesting lots of capacity to borrow as shown below:

Debt Service Costs Remain Historically Low

Source: Bespoke Investment Group

Consumers may be in a position to spend, but are they in the mood to spend? Not exactly. U.S. consumer confidence tumbled in September about both current conditions and future expectations. Consumers may be hearing bad news about sluggish corporate earnings forecast for Q3 while interest rates continue to rise. Tumbling inflation and a strong jobs market have raised hopes the Fed will be able to pull off a soft landing, but we are now, in our view, at a tipping point. Will sour expectations follow through to less spending, pushing us into a recession? Stay tuned.