After the market and sentiment hit a low on September 30, stocks had a fabulous October. The Dow surged 14.0% in October with the S&P 500 up 8.0%. NASDAQ trailed but was up 3.9%. It was the best month for the Dow since January 1976.

The most impressive part of this surge was that the mega-cap stocks provided no support. It was a brutal earnings season for the FANG+ stocks plus Tesla, with those six stocks reporting earnings off 9% on average. Facebook, Amazon, and Alphabet (Google) plunged on their reports. While many analysts and investors have now soured on FANG+ and declared their market leadership is over, we don’t agree. We think that these market leading stocks of the last decade showed they are not bulletproof, and are more cyclical than originally thought. The cycle will eventually change with accelerating economic growth at some point in the future. Meanwhile, FANG+ stocks are on sale and some of them remain as our favorites for the long-term.

The bar was set low coming into this earnings season. Still, investors are punishing companies’ stocks that miss forecasts. Margins are compressing for the fifth consecutive quarter. At some point, pricing power in an inflationary environment goes away. The U.S. dollar, up 10% year-over-year, is a major headwind.

As we expected, future earnings growth estimates are plunging. Q3 growth estimates have been revised down to +1.5% (negative excluding energy stocks) from +9.5% earlier this year. Estimates for 2023 have been reduced to 7% growth, still too high in our view. In spite of a tough earnings season, stocks rallied sharply.

The October Big Money Poll of institutional investors shows that 40% of managers are bullish about the outlook for stocks over the next 12 months, with 30% bearish. Bulls say this is an attractive entry point for both stocks and bonds.

The S&P 500 began 2022 trading at about 23x forward earnings, now about 16x estimated 2023 profits. Price/Earnings ratios are contracting by even more for many companies. Still, about 40% of poll respondents call the market overvalued, while 22% now think stocks are undervalued.

According to the poll, the three biggest risks that the stock market will face in the next six months? Rising interest rates, recession, and disappointing corporate profits. Inflation is a distant fifth in the survey.

Big Money investors are sitting on more cash than usual, waiting for better buying opportunities. Some of this cash was used to fuel the huge rally in stocks in October. How much cash is left to keep this rally going?

Mid-term elections are next week, and there have been some major shifts in the polls that appear to have tipped the balance of power for control of both the House and Senate in the GOP’s favor.

Using probabilities from the site electionbettingodds.com, control of the House has been favoring Republicans all year. The Senate has been a different story. For much of the first half of the year, Republican odds to take the Senate were well over 70%, but in summer those odds plummeted to under 30%. Since early September those odds have now bounced back to over 50%.

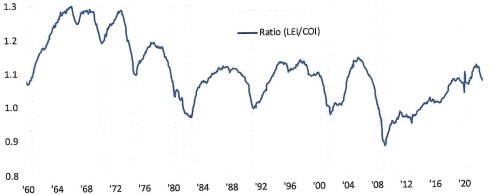

LEADING INDICATORS POINT TO RECESSION

The Conference Board’s index of leading indicators showed a larger than expected decline in September. With that decline, the ratio between leading and coincident indicators has continued to roll over and has now declined by a magnitude that has historically been followed by a recession.

RATIO OF LEADING TO COINCIDENT INDICATORS: 1960-2022

Source: Bespoke Investment Group

On a year-over-year basis, leading indicators have decline 1.45%, which is the steepest decline since the Covid crash. Historically, every time the year-over-year reading has dropped 1% or more, a recession has followed within the next year. Even the Conference Board’s own recession model now puts the odds of a recession within the next year at 96%.