With earnings coming in much stronger than expected and a series of trade policy reversals, stocks have cruised higher in May (up about 6% so far) and are now both higher for the year and within 4% of new all-time highs. The most significant walk-back came last week as the U.S. and China significantly reduced tariffs on each other from ridiculous levels.

Earnings results were especially good for tech. The AI investment boom is continuing with AI spending a key part of commitments made by Gulf countries last week on the President’s trip.

As for the economy, the divergence between hard data (economic statistics released) and soft data (business and consumer expectations) remains large. Despite this disconnect, the economy remains resilient.

Congress is a tail risk. Last Friday the House Budget Committee failed a basic procedural step in their quest for tax cuts, but advanced the bill on Sunday. Expect more eyes on this by investors.

On Sunday Moody’s downgraded U.S. debt after Standard and Poors did so in 2011 and Fitch in 2023. We view Moody’s action as old news and a non-event. The previous downgrades were both met with 10% stock market corrections. We don’t expect this to occur this time.

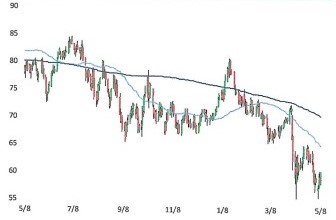

We have written before about the three-headed monster indicator. The three heads are crude oil, the dollar, and long-term Treasury yields. When all three are perking their heads up and rising, the stock market can often run into trouble. All three were rising as we entered 2025. When the three variables are trending down (like now) the market often roams higher. Take a look at the three heads:

WTI CRUDE OIL: LAST 12 MONTHS

US DOLLAR INDEX: LAST 12 MONTHS

10 YEAR TREASURY YIELD: LAST 12 MONTHS

Source: Bespoke Investment Group

Crude oil prices are trending lower, the U.S. dollar’s index is flirting with multi-year lows, and the ten-year Treasury yield, while far from a 52-week low, is more in the middle of its one-year range. The three-headed monster is flashing green for stocks.

The recent Fed meeting was revealing. While Chair Powell discussed that current economic data has not shown deterioration that would justify cuts, he repeatedly mentioned patience in watching for further data and said that he does not “think we need to be in a hurry to adjust rates.” He also discussed that in case the dual mandate (low inflation and full employment) is “in tension” the FOMC would evaluate which side would need greater attention. No surprise there.

The overall tone of the meeting was hawkish. The FOMC will not be pre-emptively cutting rates anytime soon. A cut at the September meeting is still the market’s base case.

BIG MONEY POLL TURNS BEARISH

Barron’s Big Money Poll for spring was released a few weeks ago. We follow the poll because it is a good indication of what large money managers are thinking and doing – especially doing. Here are the highlights from the recent poll:

– Thirty-two percent of respondents are bearish on the outlook for stocks over the next 12 months – the highest percentage since 1997. These results are not necessarily considered a contrary indicator like the sentiment for individual investors. Just 26% call themselves bullish on the market’s prospects – the smallest percentage since 1997. Tariff worries are only partly to blame. Professional investors also point to high equity valuations at the start of the year and concentrated AI bets that were rocked in late January when China’s DeepSeek revealed an AI model built more efficiently, at a lower cost, than U.S. models.

– The five biggest risks to the stock market in the next six months are:

Economic slowdown – 25% of respondents

Recession – 19%

Political turmoil in U.S. – 14%

Resurgent inflation – 11%

Disappointing earnings – 10% (Q1 corporate earnings turned out to be very strong)

– What should the Trump administration’s top economic priority be for the remainder of the year?

Deregulation – 38% of respondents

Tariffs and trade – 20%

Tax cuts – 20%

Deficit reduction – 5%

– Will the Magnificent Seven stocks lead the market in the next six or 12 months?

6 months – yes 10%, no 90%

12 months – yes 32%, no 58%

Our take is that there is better than a 50% chance the Mag 7 and other tech stocks will lead the S&P 500 higher over six and 12 months. Tech isn’t a fad. It is a growing part of the global economy. Tech companies are growing earnings at a much faster rate than the broader market, with much higher margins and better cash flow generation. Tech stocks should trade at higher multiples on that alone.

In summary, this is the most bearish poll we have seen in a long while and is not a good thing. These investors pull the levers on large institutional investment accounts. Maybe the (temporary) thaw in the U.S. – China trade war will change their perspective as the market moves higher off the April 8th low.