Even though the market rebound last week was coincident with the Russian invasion (possibly signaling the bad news was fully discounted), we don’t think the coast is clear, and more volatility may be with us in the short term. Investors have at least three major issues right now to wrap their arms around, and each could derail the market further:

What are Putin’s longer-term intentions? Is Ukraine enough? Will Russia retaliate against NATO for supplying arms to Ukraine? And will there be a cyberwar between the U.S. and Russia?

Will China use the limited U.S. commitment to Ukraine as an opportunity to invade Taiwan? Would the U.S. get involved in a shooting war over Taiwan?

Maybe the most important issue is how the Fed will fight inflation. Is a 50 basis point hike on the table now for the March meeting (the consensus is still 25 basis points) now that gasoline and many commodity prices have risen further and are expected to stay high? Will the Fed start ‘quantitative tightening’ (selling bonds from their balance sheet) at the same time they are raising interest rates? Will the combination choke the U.S. economy into recession?

Investors have more questions than answers these days which most likely will put a lid on share prices for a while. Yes, bull markets climb a wall of worry, but these issues are all significant and need time to sort out. We expect continued volatility with more downward pressure in the short term.

If you own stocks for the long term, a correction should not scare you. Yes, we could be heading towards a bear market, but maybe not. Selling after big drops has historically proven to be a disastrous strategy given the market has always gone on to make new highs.

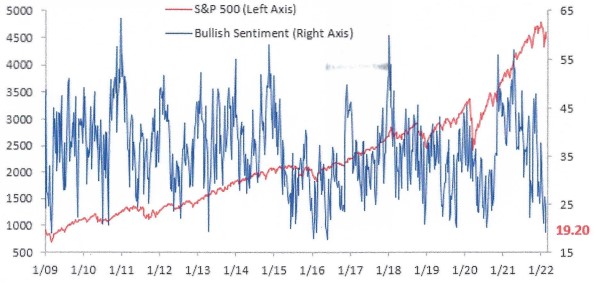

On a more positive note, sentiment surveys have eroded significantly – a positive contrarian indicator. Readings are extreme, with bullish sentiment falling below levels seen at the depths of the COVID crash, and the lowest level seen since early 2016. See below:

AAII Bullish Sentiment: 2009-2022

Source: Bespoke Investment Group

Since the AAII (American Association of Individual Investors) survey began in 1987, readings this low have seen stocks rally an average of 25% within the next year, and stocks have always been higher 52 weeks later. We are reaching a point where a little good news could go a long way. We think we are more likely to see returns back-end loaded over the next year because of the problems mentioned above.

Usually bonds buffer a balanced portfolio when stocks dip, but that is not the case this time. Through last Friday, the S&P 500 was down 8% YTD and the 20+ year Treasury bond ETF was down 7.5%. Balanced portfolios are getting hit with a double whammy! What is a traditional 60/40 balanced investor to do?

Some advisors recommend bonds be replaced with alternative investments (commodities, precious metals and private equity for example) and real estate. But that would make a balanced portfolio riskier to compensate for the fact bonds can no longer be expected to offer an adequate return.

We would avoid the temptation to become more aggressive when fixed income investment opportunities seem scarce. We would rather maintain the same 60/40 mix but reduce the portfolio’s bond market risk by holding only short-term bonds or even raising cash. If medium and long rates rise as expected, these funds can be gradually reinvested into longer-dated securities. Some advisors are challenging the wisdom of the 60/40 portfolio. We are not. Portfolios with a 60/40 mix have produced excellent risk-adjusted returns over the years and we expect that to continue