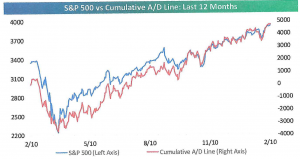

Here are a few of our favorite market internal indicators that are confirming the all-time highs in stocks. The first one, the cumulative advance/decline line (breadth), is rising along with stock prices, a healthy sign.

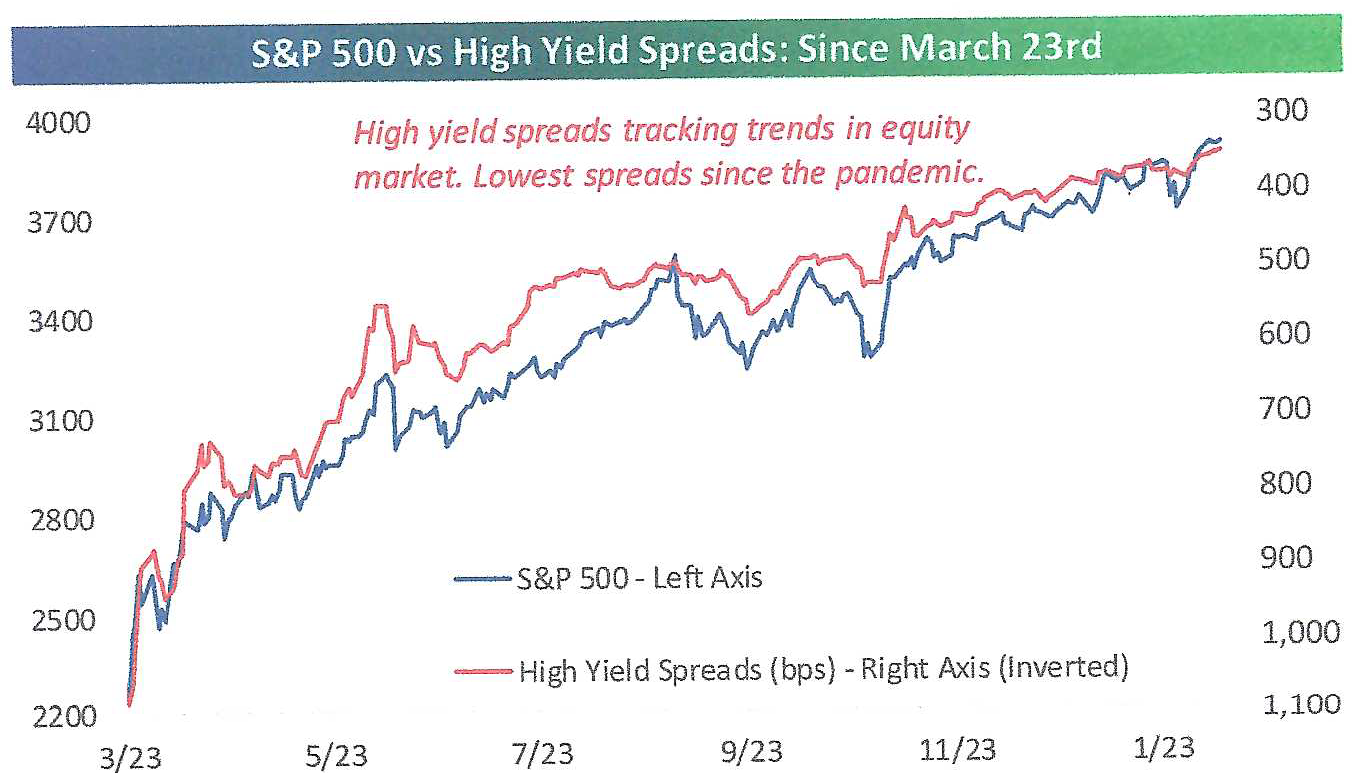

Second, high-yield bond spreads (the spread in yield between high quality and low quality bonds) are the lowest since the pandemic started. Low spreads are consistent with higher equity prices.

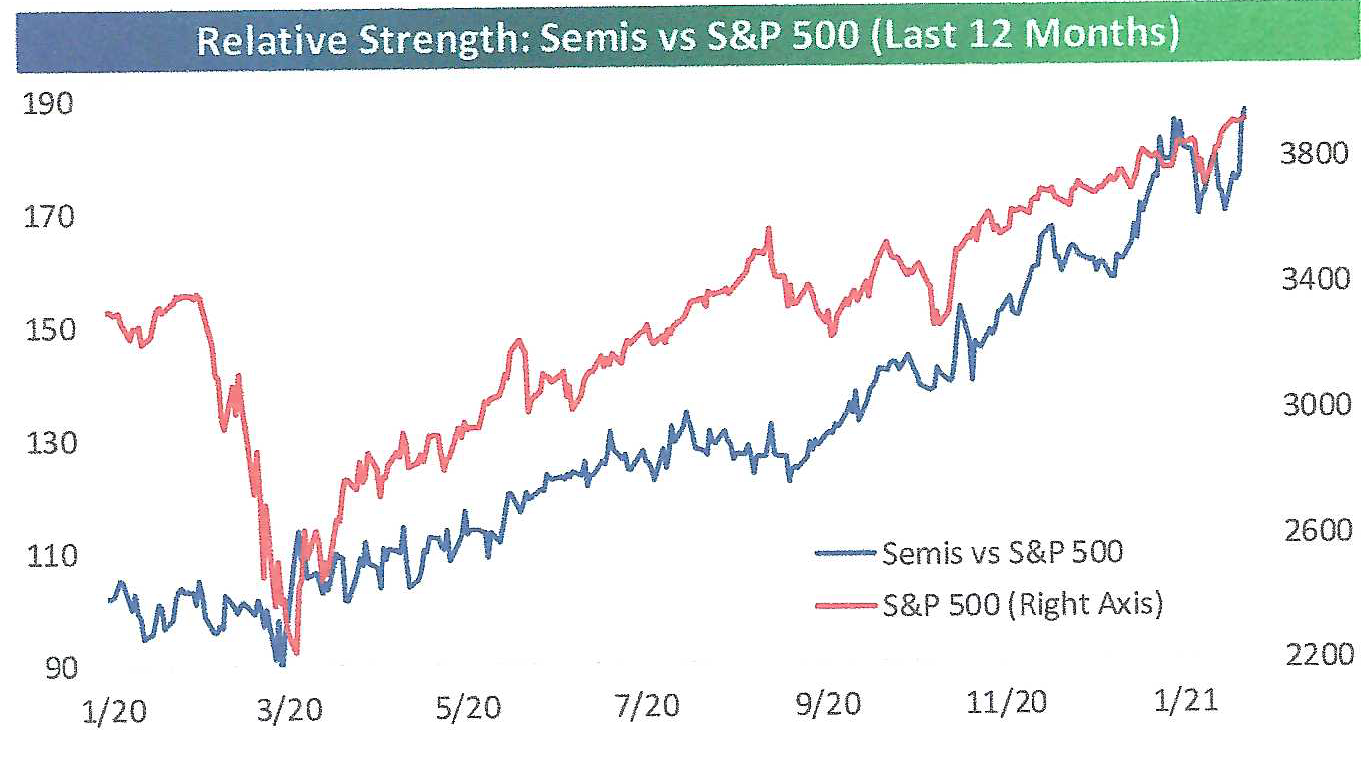

Third, semi-conductor stocks (the ‘transports’ of the 21st century) made a recovery to new highs last week. Semis have been a leading indicator of the broader market in the last few years.

Source of graphs: Bespoke Investment Group

We remain wary of rich valuations, widespread (but not irrational) optimism, and the possible return of inflation (see main section below). However, there is still plenty of thirst by investors to put money to work in stocks.

KEEPING AN EYE ON INFLATION

Mainstream thinking is that low interest rates and inflation are here to stay. This consensus is based on central bank statements of intent as well as the low-growth environment of an aging society with limited productivity gains. Is it also out of necessity? Higher interest rates would severely strain the finances of the U.S. Government.

Investors should not assume inflation is dead even though it has been dormant for over a decade. Many predicted Quantitative Easing would cause hyper-inflation, but inflation never came. Since the end of the 2008-09 financial crisis, the Consumer Price Index has increased by only 1.7% per year, falling short of the Fed’s 2% target.

So why worry about it now? We see two primary reasons: First, the money supply (M2) has grown 26.3% in the past year, the fastest growth in U.S. history to our knowledge. This is due to Covid-induced monetary policy which includes money printing and the Fed financed government programs to fund loans to businesses and direct payments to individuals. This has resulted in the Consumer Price Index rising at a 3.6% annual rate over the past six months.

The other reason is upward pressure on labor costs. The supply shocks to labor of the last 50 years (which expanded the pool of global labor available and put downward pressure on wages) have stabilized or reversed. Simply put, with the U.S. experiencing a shrinking young and middle-aged working population the pressure is on for higher wage gains going forward. This could pose a headwind to equity prices over the coming years.

The return of inflation light is flashing yellow and should be watched. An economy with inflation changes what equity investments will do best. Commodity, energy, materials, and real estate stocks should do well in an inflationary environment. Long-term bonds should be avoided. Also, be wary of investments in the most heavily indebted countries.