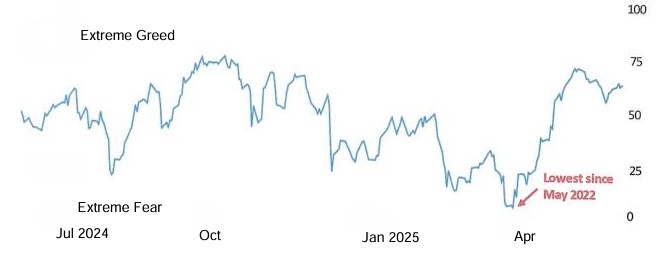

It is no surprise that as the stock market has rallied sharply off the April 8th low, sentiment improved. Is the move from extreme fear into greed territory a sign of complacency? Let’s look at two popular sentiment indicators:

First, the CNN Fear and Greed Index has exploded off its low as the S&P 500 has rallied 20%. The current reading sits just below the extreme greed level.

CNN Fear & Greed Index: Last 12 Months

Source: CNN

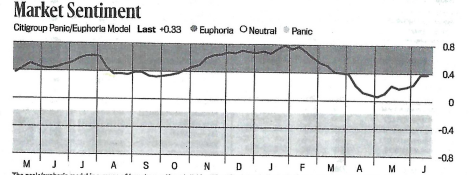

Next, the Citigroup Panic/Euphoria Model is also flashing caution as it sits just below Euphoria territory.

The panic/euphoria model is a gauge of Investor sentiment. It identifies “Panic” and “Euphoria” levels which are statistically driven buy and sell signals for the broader market. Historically, a reading below panic supports a better than 95% likelihood that stock prices will be higher one year later, while euphoria levels generate a better than 80% probability of stock prices being lower one year later.

Source: Citigroup Investment Research

Both of these models tend to be contrarian indicators and are currently flashing yellow. Maybe this is a reason to think the summer doldrums may be here.

THE MARKET IS ALWAYS FULL OF SURPRISES

Last week was looking really good for the bulls in terms of both trade and inflation. U.S. and Chinese trade officials announced an agreement for a framework for trade. Details were thin, but at least we are talking with China. And the CPI and PPI came in weaker than expected.

The May inflation data confirmed the message of March and April that consumer prices have softened early in 2025 despite tariffs. While it is too early to declare tariffs a non-factor for consumer prices over the longer-term, the data suggests that they are not having the expected impact that most economists and analysts thought. Of course, bears are shouting “just wait until next month.” But so far so good.

The employment situation is mixed. Job growth has slowed from $168K/month average pace last year to $124K average this year. U.S. population growth demands roughly 160K of monthly jobs growth to keep pace with demographics (source: Bespoke Investment Group). Income growth remains robust. Total weekly payroll disbursements are rising at a seven percent three month/three month annualized pace, significantly above the pre-Covid pace. That is more than sufficient to keep consumer spending rolling along.

Jobless claims haven’t been as encouraging. Last week’s release of initial jobless claims came in at 248K, near the high end since 2022. Continuing claims have been even more buoyant, moving to the highest levels since 2021.

Then there is the big negative surprise – the 800-pound gorilla in the room. Overnight last Thursday into Friday, Israel launched a major attack on Iranian nuclear facilities and Iranian military officials. No one knows how this conflict will develop and whether the U.S. will get dragged into the war. This is the reason the market traded down sharply last Friday. Investors are nervous.

The negative surprises mentioned above give investors good reason to expect the traditional summer doldrums this year. The summer months typically see much more muted performance versus a very strong finish in the final two months of the year. Investors should stay grounded during the dog days of summer when markets can get choppy.

What can investors learn from all of this? Think long-term because there are always market surprises, good and bad. This is the main reason market timing doesn’t work and is a loser’s game.