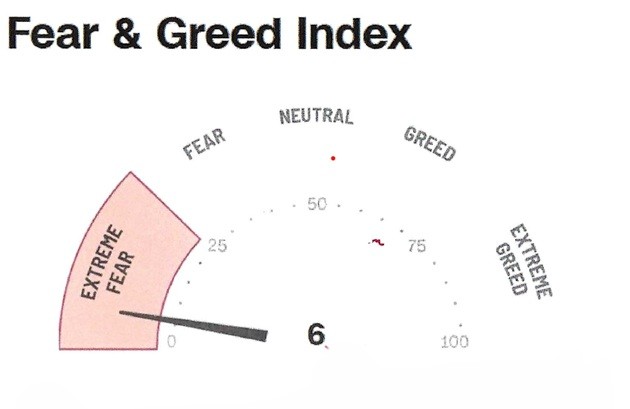

- Current retail investor sentiment is mostly mixed so not much to be taken from that. However, one indicator stands out. Last week the CNN Fear and Greed Index was sitting at one of its most “extreme fear” levels of the year – see below.

Source: CNN

Remember that retail sentiment is a contrary indicator. So, on cue, when sentiment plunged at CNN, the market sharply rallied just when investors were the most frightened. This seems to happen time and time again. Lesson for investors: forecasting the market is near impossible for retail investors and professionals alike. Get invested and stay invested.

2025 HAS BEEN A WILD YEAR

November’s extreme volatility greatly contributed to 2025’s wild ride. For the month, the S&P 500 advanced by 0.1% but NASDAQ dropped 1.5%.

Earlier in November we saw intense drawdowns in many stocks but especially in tech and AI. Bears roared the AI “bubble” needed to be popped. For a while it worked as many good tech and AI stocks, including the Mag 7, lost 10-20% seemingly overnight. Meta dropped over 20%. Long-term investors shouldn’t be overly concerned with short-term volatility, but it is still hard to watch good stocks take significant haircuts.

Things quickly turned positive in the last five trading days of November, partly on renewed optimism for a December Fed rate cut. Also, the late realization that earnings season was excellent was a factor. The stabilization of bitcoin after a massive drop probably helped, too.

In summary, the AI boom has turned into worries about an AI bubble. Given the fact there is less complacency about this mega-trend gives us confidence that there is more room for these stocks to run. We will enter 2026 with substantial exposure to tech and AI as we think they will continue to be market leaders. We will have more to say about this in our January outlook.