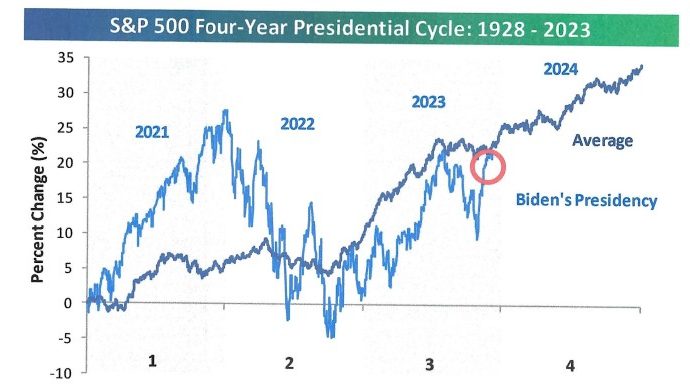

The S&P 500’s price change so far in Biden’s Presidency is now essentially right at the average gain that we have seen at this point in the four-year Presidential Cycle for the S&P 500 going back to 1928. We are now at the end of year three of the election cycle, and if the S&P 500 continues to take the traditional Presidential Cycle path, we could have a solid year four in 2024. See the chart below.

- Source: Bespoke Investment Group

CHAIR POWELL SAYS MERRY CHRISTMAS TO THE MARKETS

The Dow Jones Industrial Average is now at record highs, but that doesn’t change the fact it has basically gone nowhere in the last two years – up less than 3%. It has been a two-year push. It is, however, up 15% from this year’s October 27 low. The S&P 500 stock index is faring better, clearly in a bull market since October 2022.

We would describe the current bull market as “weird.” Usually in a bull market, everything goes up in a broad rally. That is not the case this time. The “magnificent seven” (mega-cap tech stocks) are clearly leading the charge. Without these seven stocks, the S&P 500 would only be up 8%. This is right in line with our preferred gauges for the “broader market” – the NYSE Composite and the equal-weighted S&P 500 – both of which are up about 9% YTD. And over 40% of stocks in the index are down this year! That is not typical after the first year of a bull market.

There is plenty to like, however. Retail sales are strong with holiday sales expected to rise 3.4% in 2023, a very respectable number. Consumers are still spending on durable goods. Gasoline prices are down. Semiconductor stocks, a leading market indicator, have been very strong. The list goes on.

While Chair Powell could not come out and say Merry Christmas to investors, he basically did so in his presser last week. He (the Fed) downgraded inflation forecasts, upgraded GDP, and reduced the path of the Fed Funds rate. The Fed gave a giant thumbs up to further strong performance from risk assets into 2024.

For the rally to continue into next year, economic data will need to show some improvement, especially in the manufacturing sector, which has been stuck in a recession for over a year now. And corporate earnings will have to hit the mark, expected to be up 11.5% in 2024 (source: FactSet). We will expand on this list in January’s market commentary.