Many professional investors think the bond market is a better forecaster of future economic strength than the stock market. What is the bond market currently telling us? One bond market indicator, credit spreads, is signaling the coast is clear and current labor market softness will not take down the overall economy. After all, growth in real GDP is running at about a 3% annual clip. Credit spreads are the difference in yield between high-yield (junk) corporate bonds and investment grade corporate bonds. Investors demand a higher risk premium (spread) on high-yield debt when the economic outlook is unclear or deteriorating. But currently, risk premiums on high yield corporate bonds are eying cycle lows from last year given the assumption Fed rate cuts should support economic activity without much fear of damaging inflation. Bottom line: this bond market indicator is giving the all-clear to risk assets.

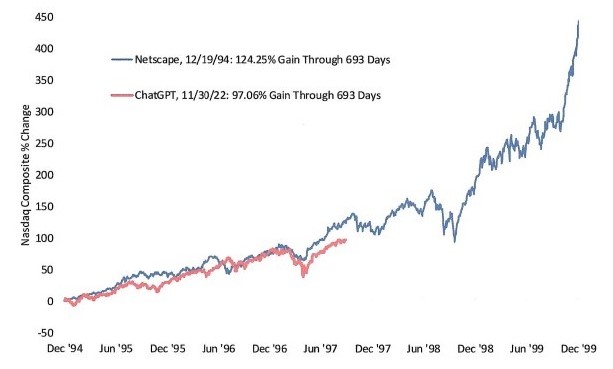

We would like to give you an update on the ChatGPT versus Netscape chart since their respective releases in 2022 and 1994. The Netscape browser launched the dot-com boom of the 1990s. The release of ChatGPT in October 2022 kicked off the AI boom. The chart patterns are very similar, as shown below:

Nasdaq Composite % Change in the 5 Years After Netscape Release vs. ChatGPT Release

Source: Bespoke Investment Group

There is no guarantee this close tracking will continue, but if the pattern holds, the AI boom has years left of runway.

ALL EYES ARE ON THE FED

According to the CME FedWatch site, there is a 94% probability the Fed will cut by 25 basis points at tomorrow’s meeting, and a 6% chance the cut will be a half-percentage-point. What’s most important is that this is not viewed as a one-and-done cut. Rather, three total cuts of 75 basis points are expected by investors this year, and another 2-3 cuts of 25 basis points each in 2026. Clearly, the markets are expecting the Fed easing cycle to resume in earnest.

The FOMC has made it clear their concern over labor market deterioration outweighs any potential risk to inflation expectations from tariff-driven goods inflation. Let’s look at what the Fed is likely to discuss at their two day meeting:

First, tariff-driven inflation is running above 2% and accelerating. Tariff prices are not hitting all at once. Instead of a one-off shock, tariff inflation is dribbling into the economy. This raises the odds it will be viewed as more permanent by consumers.

The employment situation includes three major policy shifts this year that have had a major impact on payrolls. First, tariffs led to a surge in uncertainty and plunging business confidence earlier this year. It is no surprise that this uncertainty led to a sharp drop in net job creation in the middle of the year. Second, government employment has started to drop as a result of changes announced by the Trump administration since January. Third, deportation, while difficult to quantify, has been a factor in payroll reduction. Taken together, these three factors make a significant slowdown in job creation seem like the most probable outcome.

The resumption of the easing cycle may be good for stocks, especially since there is little fear of a widespread recession at this point. Lower rates will ease the discount rate on future cash flows from corporations which push up a stock’s intrinsic value. Lower rates also make bonds less competitive as an alternative to stocks, among other factors.