- This quarter’s earnings season just started last week, so it is still early. Results were centered on the big banks which mostly reported blow-out earnings and revenues. The stock reactions, however, were mixed. When the bar is set high heading into earnings season like this quarter, the market’s performance has been uneven. Consensus estimated growth in earnings for this quarter is 24% (source: FactSet), with about 26% growth forecast for all of 2021. Strong earnings growth helps justify today’s rich market valuations (see main section below). Earnings growth combined with low bond yields and full fiscal and monetary stimulus are giving investors confidence that forward returns will be positive combined with little fear of a big drop.

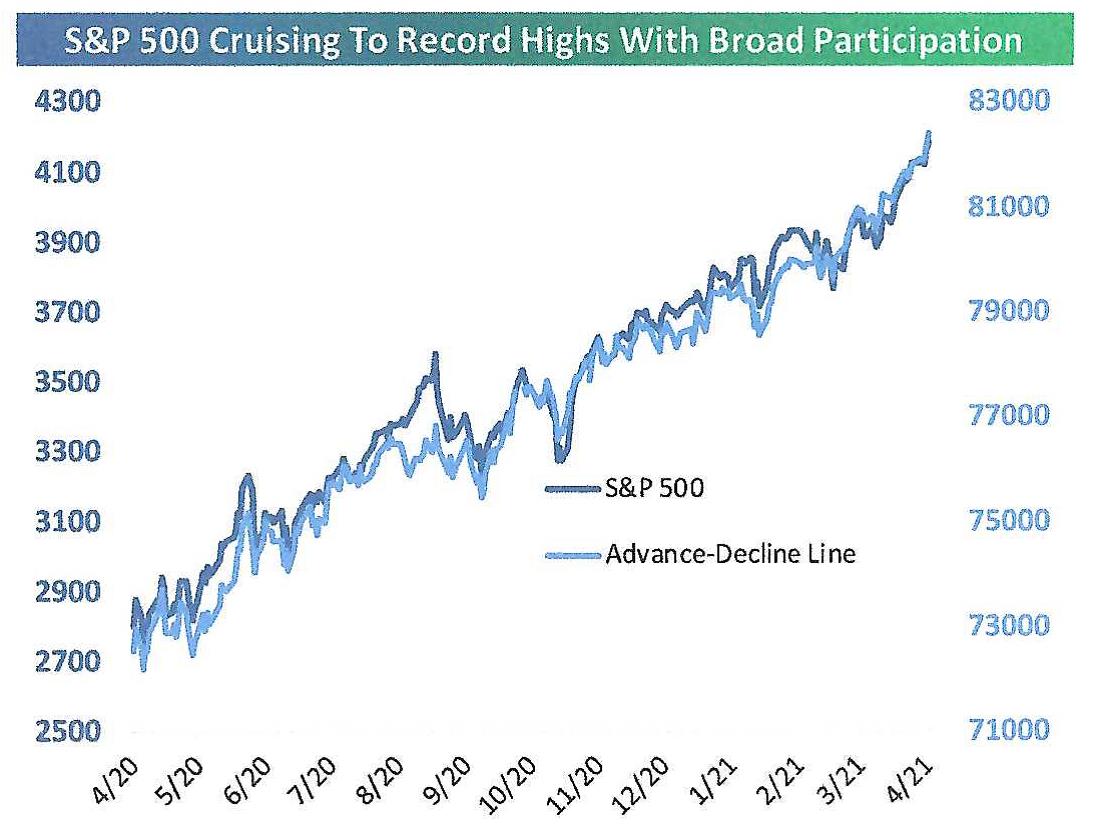

- As stocks March higher, there is broad participation which is a very healthy sign. The S&P 500 advance-decline line has been making new highs along with the market over the past year, a sign that gains are spread across a wide array of companies rather than concentrating on a few big gainers. See the graph below:

Source: Bespoke Investment Group

WHEN EVERYTHING IS PRICEY

The good news for investors is that the economic rebound from COVID-19 is looking like it is real. The bad news is that financial assets have never been so expensive at the start of a recovery.

How can money managers and other investors justify buying stocks when valuations are at their highest starting point for a recovery ever? Partly because earnings will likely rebound faster than previous crises or recessions. In fact, all the appreciation in the S&P 500 this year has come from higher earnings rather than higher multiples on those earnings. Also, companies will discuss how operating changes made during the pandemic should help sustain higher margins – a key metric supporting equity valuations, in our view.

In spite of high valuations, more money has flowed into stocks in the last five months than in the last 12 years! Bank of America has likened the stampede to a “melt-up” in markets.

While there are signs of irrationality (IPOs, SPACs), many of today’s market leaders are tech giants that print money, unlike the dot.com era when valuations were based on clicks or eyeballs.

The problem with an ‘everything rally’ is that everything is expensive, including bonds and real estate. Bond yields are near 40-year lows. Maybe the real bubble is in bonds, not stocks.

High valuations don’t necessarily point to a crash ahead. Rather they are an indication that forward returns will likely be lower than average, probably a good bet over the next few years.

It is hard for investors to sit still in frothy markets, but that’s exactly what they should do. Waiting for a bubble to burst based on high valuations has led to terrible investment decisions in recent decades. We agree with the late investing legend Jesse Livermore who once said, “Money is made by sitting, not trading.” Stay the course.